The trend of pursuing education in Canada has gained significant traction among international students, owing to its exceptional academic benchmarks and global recognition. Canada's allure lies in its forward-thinking higher education framework, streamlined visa application process, and promising prospects for job placements. Renowned for their academic excellence, Canadian universities, and colleges consistently secure positions among the world's top-ranking institutions, with three institutions currently claiming spots within the top 50 worldwide.

The growth of Indian students choosing Canada as their study destination has been remarkable, experiencing an astounding 260% surge since 2013. This surge culminated in an impressive international enrolment count of 800,000 students in 2022. Notably, Indian students constitute more than 28% of the entire international student cohort in Canada.

The year 2022 witnessed an issuance of 226,450 study permits to Indian students, a substantial rise from the 52,645 permits granted in 2016. As of 2023, an impressive 753,000 students have successfully secured Canada student visas.

Canada's educational landscape flourished due to its diverse array of programs, cutting-edge research facilities, and exceptional provisions for athletics, sports, and recreational activities. This convergence of factors has significantly enhanced the higher education system.

Canada's high quality of living, commitment to diversity and equality, peaceful societal fabric, and robust placement opportunities collectively contribute to its magnetism for international students. A significant proportion of the international student body hails from Asian nations such as India, China, and Korea, underlining their substantial contribution to Canada's higher education community.

In this comprehensive guide, we will delve into the various components that contribute to the overall cost of studying in Canada, including tuition fees, living expenses, healthcare, and other miscellaneous costs. By the end of this article, you will have a clear understanding of what it takes to pursue your education in the Great White North.

In this blog we will cover the following topic:

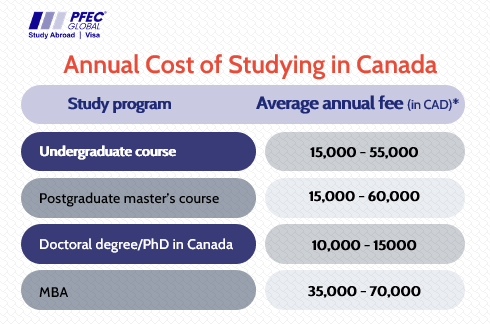

The primary financial commitment during your academic journey is the tuition fee. The amount you spend on tuition is contingent upon the level of qualification you pursue and the institution you select. To cover this expense, you should budget approximately between CAD 13,000 and CAD 35,000 per year.

Typically, courses in fields such as humanities, education, and arts tend to be more affordably priced. Conversely, disciplines like medicine and engineering are inclined to carry higher costs.

If your aspiration is to engage in postgraduate studies, you can anticipate a higher tuition fee, the specific amount varying in accordance with the program you choose. Like trends in other countries, MBA programs stand out as some of the most financially demanding. The average expense for enrolling in these programs falls within the range of CAD 30,000 to CAD 42,000.

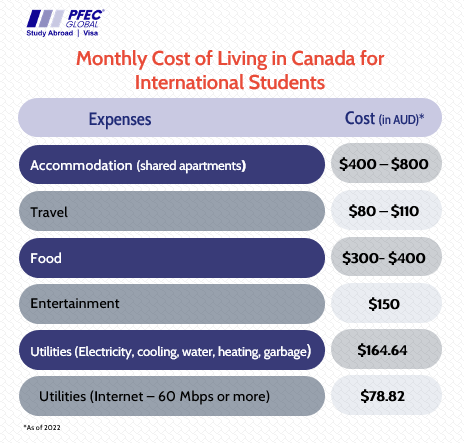

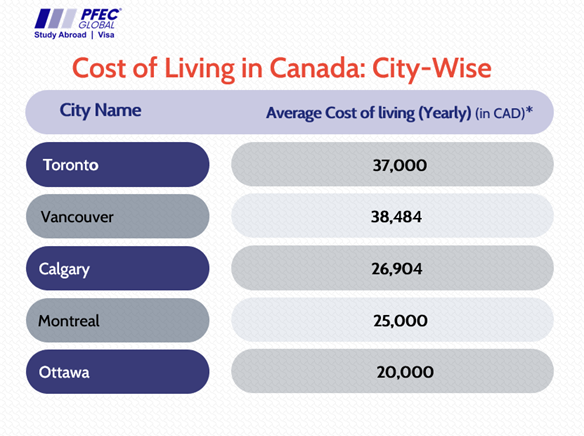

Another critical factor to consider is the cost of living in Canada. This includes accommodation, food, transportation, and other daily expenses. The cost of living varies across provinces and cities. Metropolitan areas like Toronto, Vancouver, and Montreal tend to have higher living costs compared to smaller cities. On average, a student can expect to spend around CAD $10,000 to $15,000 per year on living expenses. Rent for a shared apartment can range from CAD $600 to $1,200 per month, depending on the city and neighbourhood.

Accommodation:

Accommodation is a significant portion of living expenses. Students have several options, including on-campus dormitories, off-campus shared apartments, homestays, and private rentals. On-campus accommodation offers convenience but might come at a slightly higher cost. Off-campus options provide more independence but require careful budgeting.

Food:

Food expenses can vary greatly depending on personal eating habits and whether a student chooses to cook at home or dine out. On average, a monthly food budget can range from CAD $200 to $400. Cooking at home is generally more cost-effective than eating out regularly.

Transportation:

Transportation costs include fares for buses, trains, and other forms of public transportation. Many cities offer student discounts on public transportation passes, which can help reduce costs. A monthly transportation pass might cost around CAD $80 to $120.

To know more about Standard of Living in Canada Read our Blog: Standard of Living in Australia: A Comprehensive Guide for International Students

Before commencing their academic journey, students are obligated to possess health insurance coverage that spans across provinces. The cost of this insurance is contingent upon the selected policy and can fluctuate between CAD 300 (INR 17,000) to CAD 800 (INR 44,000) per year. To gain a comprehensive understanding of the health coverage available, it is advisable to explore university websites and the official websites of provincial health ministries.

To know more about Standard of Living in Canada Read our Blog: Standard of Living in Australia: A Comprehensive Guide for International Students

In Canada, embarking on a journey of higher education often entails acquiring essential resources to facilitate effective learning. Much like the global trend, the expenses associated with study materials and equipment can significantly fluctuate based on the chosen academic field.

For disciplines like social sciences and humanities, textbook costs may range from CAD 200 to CAD 500 annually, depending on the course requirements.

These expenses can cumulatively amount to around CAD 1000 - CAD 1500 per year, with higher costs associated with particularly specialized programs.

The financial outlay for these digital resources typically ranges from CAD 100 to CAD 500 annually, contingent on the program prerequisites.

These costs might accumulate to roughly CAD 100 - CAD 300 on an annual basis.

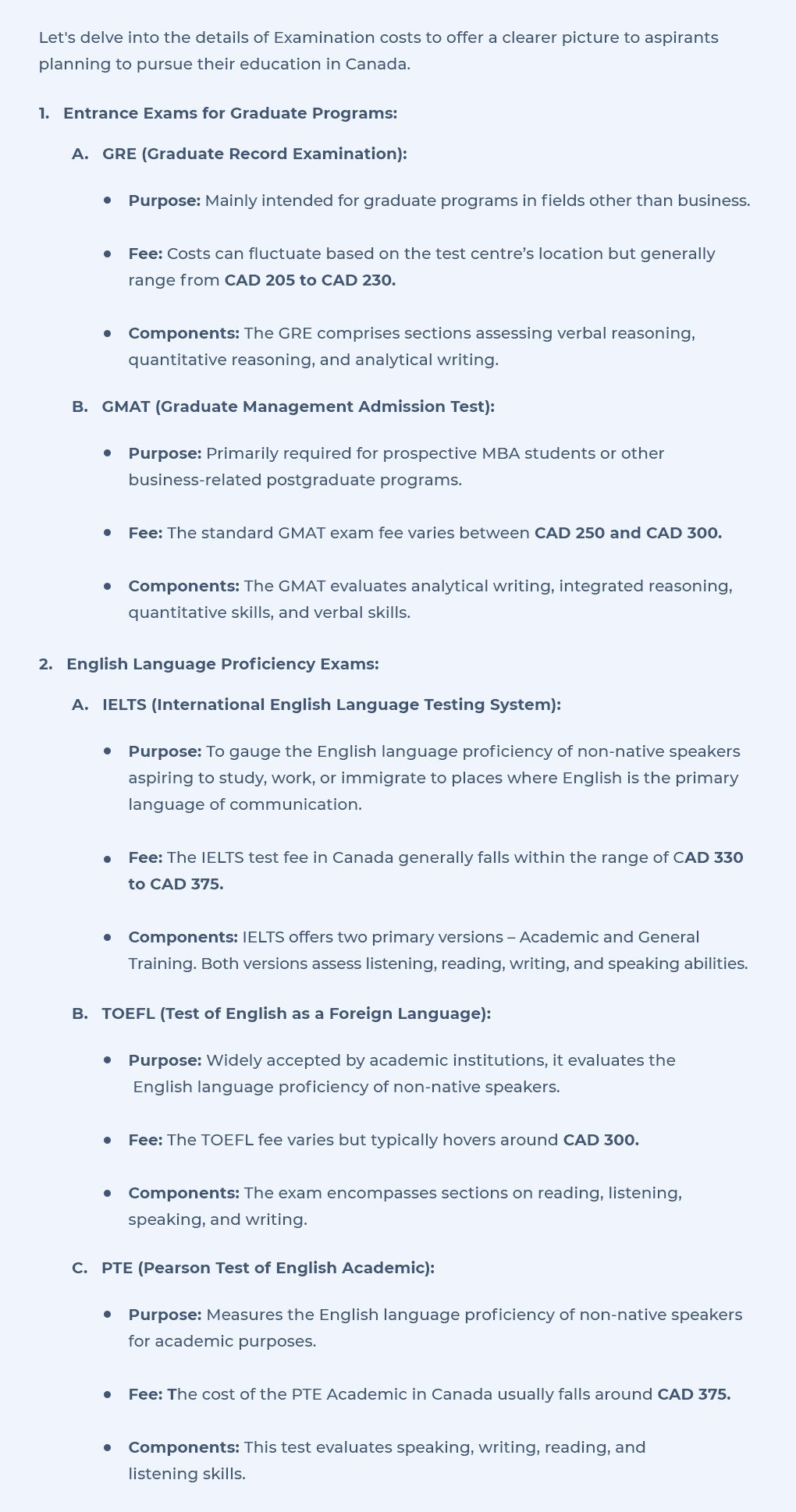

Canada, renowned for its exceptional educational institutions and diverse academic offerings, remains a favoured destination for international students. However, while the prospect of studying in the Great White North is enticing, navigating the initial stages, particularly the financial aspects associated with entrance and proficiency exams, can appear daunting.

Importance of These Examinations:

Entrance exams such as GRE and GMAT serve as crucial indicators of a student's readiness and capability for demanding postgraduate programs. Leading universities employ scores from these tests to make informed admission decisions.

English proficiency assessments guarantee that international students possess effective communication skills, can comprehend course materials, and actively engage in classroom discussions, ensuring their success within an English-speaking academic environment.

Recommendations:

Students who are in the process of applying to Canadian universities will necessitate obtaining a Canadian Study Permit, which serves as a student visa throughout their stay duration. In cases where the course or program lasts for a span of 6 months or less, acquiring a Canadian study permit is not obligatory.

However, if they opt to prolong their stay, an application for a study permit becomes imperative. The expenditure linked to obtaining a Canadian study permit is CAD 150 (equivalent to INR 8,542). The fee for processing the application can vary contingent on factors such as the specific university and the nationality of the student.

For securing a student visa, international students are mandated to present evidence of financial resources, alongside an acceptance letter and additional pertinent documentation. The minimum financial balance stipulated for eligibility to apply for a Canadian student visa is INR 6,00,000 or higher for a duration of one year.

To know more about Student Visa for Australia Read our Blog: A comprehensive Guide to Student Visa for Canada: Types, Requirements, and Application Process

Canada, often referred to as the "Great White North," is renowned not only for its esteemed educational institutions but also its stunning landscapes, lively cities, and a plethora of recreational opportunities.

As an international student, the adventure extends far beyond the classroom, with exploring Canada's natural beauty and diverse culture being an integral part of the overall experience. However, engaging in these activities comes with its own set of financial considerations.

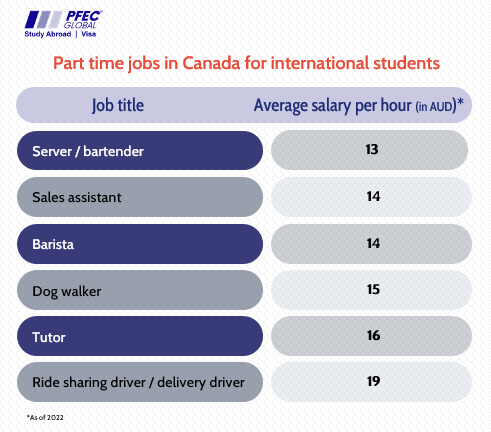

Canada offers a range of well-received part-time job options for international students. While pursuing their studies, students can engage in various part-time positions to cover living expenses and alleviate financial pressures.

During academic terms, students can work up to 20 hours per week either on or off-campus. Moreover, during summer or winter breaks, they have the flexibility to work full-time without the necessity of a work permit. To be eligible for such employment, students must fulfil the following criteria:

In Canada, there exist various forms of financial assistance, such as scholarships, grants, and bursaries, tailored for both undergraduate and postgraduate international students aiming to pursue their studies. Numerous universities additionally provide their own array of scholarships, encompassing categories like academic excellence, athletic achievements, and discipline-specific grants.

It is essential for students to thoroughly review the eligibility prerequisites for each scholarship and devise their plans accordingly.

Outlined below are some of the prominent scholarships available in Canada:

1. Vanier Canada Graduate Scholarships:

Benefits: The Vanier Canada Graduate Scholarships offer a significant financial award of $50,000 per year for up to three years, assisting recipients in covering their living expenses and focusing on their doctoral research.

Eligibility: Applicants must be nominated by a Canadian institution, demonstrate academic excellence in their field of study, and be pursuing a doctoral degree in the natural sciences, engineering, health research, social sciences, or humanities.

2. Ontario Graduate Scholarships:

Benefits: The Ontario Graduate Scholarships provide financial support to offset tuition costs and living expenses, helping students concentrate on their studies and research.

Eligibility: Applicants must be pursuing a master's or doctoral program at an eligible Ontario university, demonstrate academic merit, and meet citizenship/residency requirements.

3. President’s Scholarship for World Leaders:

Benefits: This scholarship covers full tuition and fees, enabling international students to pursue their studies without financial barriers.

Eligibility: Candidates must be entering any of the University of Winnipeg's divisions for the first time, show leadership qualities, and maintain a minimum GPA.

4. Lester B. Pearson International Scholarship Program:

Benefits: Recipients receive comprehensive financial coverage, including tuition, books, incidental fees, and full residence support, providing a worry-free environment for their undergraduate studies.

Eligibility: Applicants must be international students nominated by their secondary school, exhibit exceptional academic achievement, and demonstrate leadership and community involvement.

5. International Leader of Tomorrow Award:

Benefits: This award provides financial assistance to cover tuition and living expenses, making higher education accessible for outstanding international students.

Eligibility: Candidates must be entering the University of British Columbia for the first time, showcase excellent academic records, and demonstrate leadership potential and community involvement.

6. University of Manitoba Graduate Fellowship (UMGF):

Benefits: The UMGF offers financial support to help graduate students focus on their studies without worrying about financial constraints.

Eligibility: Applicants must be enrolled in a full-time master's or doctoral program at the University of Manitoba and maintain a minimum GPA.

7. Assist-On Scholarship:

Benefits: The benefits of the Assist-On Scholarship vary by institution but generally provide financial relief by covering a portion of tuition fees.

Eligibility: Eligibility criteria can vary, but generally, applicants need to demonstrate academic excellence and meet the requirements set by the specific university offering the scholarship.

8. Trudeau Foundation Scholarships:

Benefits: Trudeau Foundation Scholarships offer financial support to doctoral students undertaking innovative research projects with a focus on public policy and societal issues.

Eligibility: Eligibility criteria include academic excellence, research relevance, and alignment with the foundation's thematic areas.

Candidates interested in these scholarship programs should thoroughly review the specific eligibility criteria, application deadlines, and required documents on the respective scholarship program websites.

While Canada certainly presents its own array of expenses, a direct comparison with renowned educational hubs like the USA and the UK often reveals an intriguing observation. The costs associated with studying in Canada frequently parallel, if not fall below, those encountered in the nations.

This phenomenon becomes particularly evident when evaluating the return on investment across critical parameters such as educational quality, potential career opportunities, and overall quality of life.

Delving into a comprehensive analysis of educational value in relation to expenditure across prominent global academic destinations highlights Canada's position as an economical choice for prospective students.

Not only do tuition fees and living costs tend to be more affordable compared to countries such as the US and the UK, but Canada also boasts one of the highest living standards on the global scale.

Embarking on the adventure of studying abroad brings not only excitement but also the challenge of handling finances in a foreign country. The combination of living costs, tuition fees, and personal expenditures can accumulate swiftly. However, with strategic planning and informed approaches, international students can navigate their academic journey in Canada without enduring undue financial stress. Here are detailed tips to effectively manage expenses:

By applying these strategies, international students can effectively manage their finances during their academic journey in Canada, ensuring a rewarding and financially sustainable experience.

Studying in Canada offers a wealth of academic and cultural opportunities, but it is essential to be prepared for the associated costs. Tuition fees, living expenses, healthcare, and other miscellaneous costs can add up quickly. However, with careful planning, budgeting, and potentially part-time work, you can manage the expenses and make the most of your educational journey in Canada. Remember to research thoroughly, explore scholarship options, and create a realistic financial plan before embarking on your study adventure in the Great White North.

Studying abroad is an exciting and life-changing experience that offers students a chance to gain a global perspective and valuable exposure ...

In our rapidly globalizing world, where boundaries are melting away and opportunities abound, proficiency in the English language has become ...

Choosing to pursue higher education abroad is an exciting and life-changing decision. Among the plethora of options available to internationa...

Studying abroad is a life-altering adventure that opens doors to new cultures, experiences, and opportunities. Among the plethora of global s...

Australia, renowned for its world-class education and diverse cultural experiences, continues to be a favoured destination for international ...

Australia is not just famous for its iconic Sydney Opera House, the Great Barrier Reef, and its unique wildlife; it is also recognized global...

Studying abroad is a life-changing decision, and with so many options available, it can be overwhelming to choose the right country and univers...

As of March 2022, Australia has seen a consistent rise in its international student numbers, with enrolments reaching 440,219. This marks an ...