The USA, celebrated for its pioneering spirit, world-renowned educational institutions, and melting pot of cultures, stands as a global beacon in healthcare innovation. Its healthcare system, a blend of public and private providers, offers a wide range of services and is at the forefront of medical research and technology. For international students making the USA their academic home, it's vital to comprehend the healthcare landscape they'll navigate. This article delves deep into the medical and healthcare facilities that international students in the USA can anticipate during their stay.

In this blog we will cover the following 15 topics:

The U.S. healthcare system is a combination of public and private providers. While the government offers certain programs like Medicaid (for low-income individuals) and Medicare (primarily for seniors), many Americans rely on private health insurance, often provided by their employers. For international students, the scenario is a bit different, which leads us to our next point.

Most U.S. educational institutions require international students to have health insurance, either through the school's plan or by presenting proof of comparable coverage. The specifics of these plans can vary, but they generally cover basic health needs. Students should thoroughly review any policy they're considering to ensure it meets their needs and the school's requirements

Before diving deeper, let's clarify who can access health services tailored for international students:

Various health insurance alternatives are available for international students on US student visas, as outlined below:

Students pursuing their MS in the USA can avail of scholarships. To handle medical expenses, several insurance plans are accessible. Here's an overview of health insurance options for international students in the US:

• H1B Health Insurance: This insurance option offers both short-term and long-term plans. While the long-term plan caters to domestic students, international students can avail of the short-term H1B insurance plan from private providers. The GeoBlue Xplorer is often recommended for those on an H1B visa. Benefits of the short-term H1B visa include coverage for emergencies, surgeries, and hospital stays.

• F1 Visa Insurance: This insurance aligns with the University-Mandated Group Plan, Waivable University Group Plan, and Voluntary Plan frameworks. It isn't tied to any government-mandated health insurance requirements for studying in the US.

• OPT Health Insurance: Insurance for OPT students stands apart from standard plans. Those on OPT with a University-Mandated Group Plan should explore private providers for coverage. However, students on a Voluntary Plan can maintain their existing coverage during their OPT phase.

• M1 Visa Insurance: The coverage under M1 visa insurance adheres to the University-Mandated Group Plan, Waivable University Group Plan, and Voluntary Plan guidelines.

• J1 Visa Health Insurance: Tailored for international students and exchange participants in the US for brief durations, this plan provides essential health coverage.

• O1 Visa Health Insurance: Catering to O1 visa holders, this insurance encompasses health care costs, pre-existing medical conditions, health assessments, and other related medical expenses.

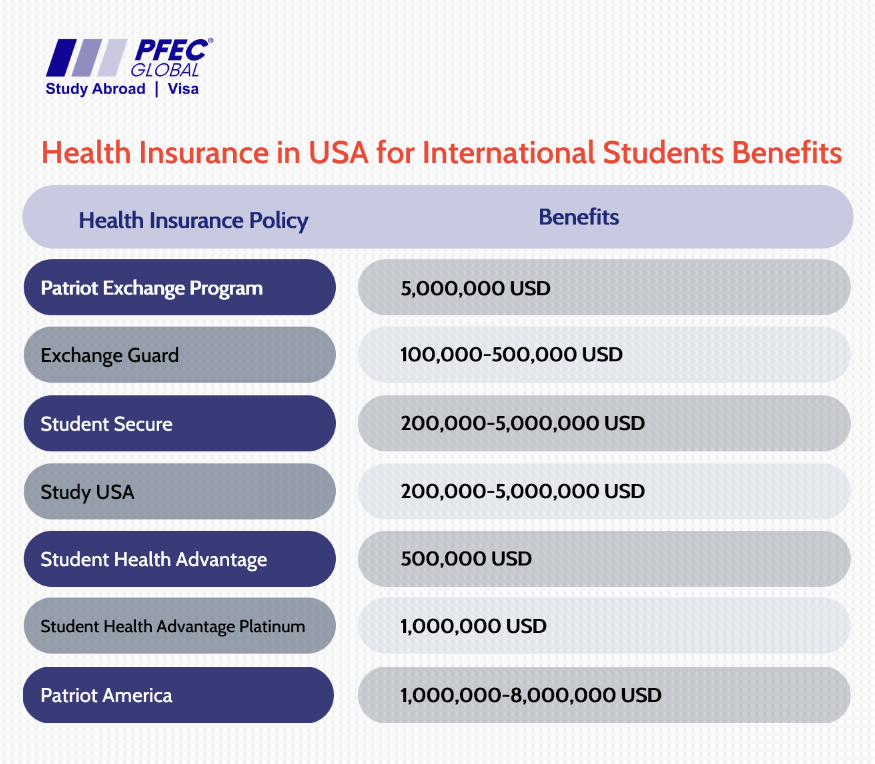

Students should carefully evaluate the advantages when selecting top-tier health insurance for international students in the USA. Those pursuing PhD programs can also avail of a stipend in the USA through scholarship applications. Opting for cost-effective health insurance options for foreign students in the USA is advisable. The following table underscores the perks of health coverage for international students in the US:

Upon fulfilling the necessary criteria and enrolling in a student health plan:

Even with health insurance, not all services are fully covered. Students might encounter out-of-pocket costs, and some services could be excluded entirely.

For instance, elective or cosmetic procedures, specific dental and vision treatments, alternative therapies, and travel vaccines might not be part of the standard coverage. Always review the insurance policy's details and exclusions to ensure you're adequately informed.

US-based health insurance companies usually partner with a network of healthcare providers. This system enables them to directly settle your medical bills with hospitals, clinics, or doctors, eliminating the need for you to make out-of-pocket payments.

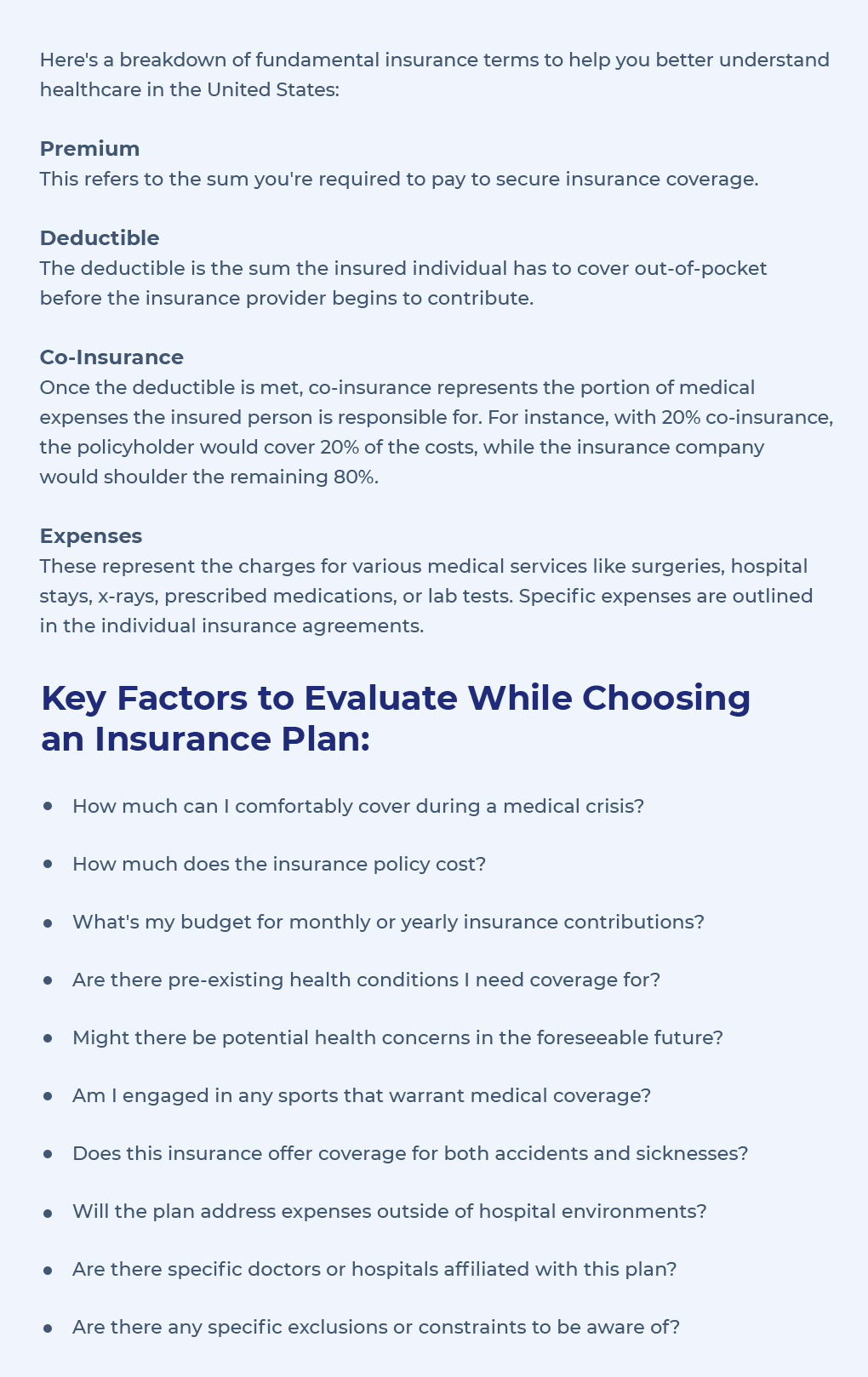

These plans frequently offer specified coverage limits, such as coverage for two annual X-rays and one consultation with a specialist. At times, you might be required to pay a deductible, perhaps around $100, after which the insurer will handle the remaining expenses.

Some insurance providers operate on a reimbursement model, meaning you may have to pay the initial medical bills, potentially amounting to several thousand dollars, and later get reimbursed by the insurer. It's crucial to understand your provider's payment mechanism to prevent any unexpected financial burdens.

Often, insurers require policyholders to submit claims along with supporting documents to assess the validity of the claim. Receiving reimbursement isn't always guaranteed.

If any discrepancies or untruths are identified in your application or if specific policy terms are violated, the insurance company may deny coverage. It's vital to provide accurate and complete information from the outset.

Students can seek financial aid through FAFSA to obtain budget-friendly health coverage in the USA. The key determinants for the pricing of health insurance for overseas students include:

Many American universities have on-campus health centres. These facilities provide basic medical services, from treating common illnesses to offering preventive care. For international students, these centres can be the first point of contact for health concerns. However, for more severe conditions or specialized treatments, referrals to off-campus healthcare providers might be necessary.

The U.S. boasts some of the world's best specialists and healthcare facilities. If a student needs specialized care, their primary doctor or the university health centre will typically provide a referral. It's essential to ensure any specialist or healthcare facility you visit is covered by your insurance to avoid hefty out-of-pocket expenses.

In emergencies, the U.S. has a vast network of hospitals equipped with emergency rooms (ERs) to handle immediate and severe health concerns. It's important to note that ER services can be expensive, even with insurance. However, in life-threatening situations, it's always a priority to seek immediate medical attention.

Pharmacies are widely available across the U.S., from large chains to local drugstores. If a doctor prescribes medication, students can purchase it from these pharmacies. Prices for medications can vary, so it's wise to have prescription drug coverage in your insurance plan.

Studying abroad can be stressful, and it's crucial to prioritize mental well-being. Many U.S. universities offer counselling and psychological services for students. These services are often low-cost or even free. Additionally, there are numerous helplines and organizations dedicated to mental health support.

Unlike general healthcare, dental and vision care often require separate insurance plans in the U.S. Regular check-ups, cleanings, eye exams, and corrective lenses can be costly without insurance. International students should consider if adding dental and vision coverage to their plans is right for them.

The U.S. healthcare system is often criticized for its high costs. Before seeking treatment, it's advisable to understand the costs involved. Always check with your insurance provider about coverage limits, co-pays, deductibles, and any out-of-pocket expenses.

International students should regularly check with their university's health services department for updates on healthcare policies or any health advisories, especially in the wake of global health concerns.

Remember, while your primary goal might be academic achievement, maintaining a balanced and healthy lifestyle is crucial for overall success and well-being during your time in the U.S.

Navigating the U.S. healthcare system can seem daunting, especially for international students away from their home countries. However, with adequate insurance coverage and a good understanding of available resources, students can ensure they receive the best care possible during their time in the U.S. Always prioritize your health and seek assistance when needed. After all, a healthy student is a successful student!

Studying abroad is an exciting and life-changing experience that offers students a chance to gain a global perspective and valuable exposure ...

In our rapidly globalizing world, where boundaries are melting away and opportunities abound, proficiency in the English language has become ...

Choosing to pursue higher education abroad is an exciting and life-changing decision. Among the plethora of options available to internationa...

Studying abroad is a life-altering adventure that opens doors to new cultures, experiences, and opportunities. Among the plethora of global s...

Australia, renowned for its world-class education and diverse cultural experiences, continues to be a favoured destination for international ...

Australia is not just famous for its iconic Sydney Opera House, the Great Barrier Reef, and its unique wildlife; it is also recognized global...

Studying abroad is a life-changing decision, and with so many options available, it can be overwhelming to choose the right country and univers...

As of March 2022, Australia has seen a consistent rise in its international student numbers, with enrolments reaching 440,219. This marks an ...